i’ve been buying, growing, and selling SaaS apps with my partner at Fork Equity since 2017. several transactions and a lot of lessons learned later, in 2019 we created the de facto course on how to buy small companies.

they say dealflow comes from many places. a few weeks ago, one of our alumni students sent me an email introduction to James Player, founder of Merge Freeze. a week after that, we agreed to buy the company.

here’s the story behind why and how we did this, dedicated to future entrepreneur-by-acquisition owners.

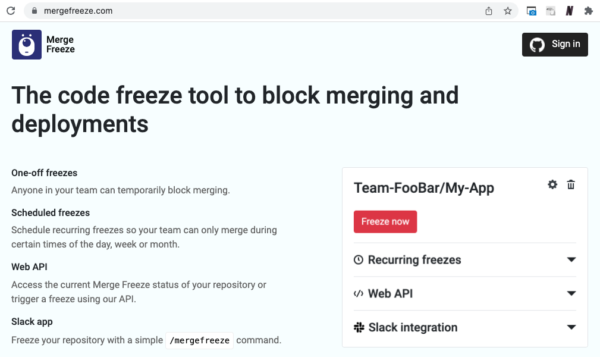

what is Merge Freeze?

Merge Freeze is a GitHub plugin that helps developers prevent bugs by giving them a single keystroke command (Slack, web UI, api) to prevent code merges.

why would a developer want to do this? perhaps they broke something on the production branch, and freezing it is the safest way to prevent a pile-on of bugs by other developers. it’s also useful for preventing weekend merges, holiday merges, and so on, via the “recurring schedule” feature.

sales pitch aside, here’s the alpha. Merge Freeze adds a tiny dose of centralized management (merge veto’s) to an otherwise highly decentralized workflow: async engineers, working remotely. for this reason, i love it.

why buy it?

i’ve never started, owned, or operated a developer tool. my speciality is marketing automation, website widgets, and trolling. i’m also not the target audience for Merge Freeze… our customers’ average team size is 105 people.

but i do know one thing: the power of first-mover advantage in a growing marketplace.

as of this writing Merge Freeze is the first (and only) of its kind on the GitHub Apps Marketplace, and the entire marketplace has only 521 applications.

i can’t help but feel deja vu when comparing this statistic to Fomo.com, our 2016 acquisition that’s netted over $3m on the Shopify Apps marketplace alone.

for these reasons we think Merge Freeze has the potential to slay:

- first-mover advantage

- sustainable customer lifetime value

- non-competitive to venture backed companies

- moderate barrier to entry (Microsoft + GitHub compliance checks)

- doesn’t have any access to customers’ code(!)

- service “just works,” with no need for fancy bells and whistles

James, founder of Merge Freeze, built a tidy product that does what it says on the tin. thanks to James we’ll be able to focus on growing the customer base instead of fixing AngularJS bugs. not something i can say about all of our [cough] acquisitions. ;)

what’s next

at Fork, we practice what we preach. onboarding Merge Freeze is a 3 part process:

- Makeover

- Add value

- Go to market

Makeover

i’m a sucker for pretty design, even if it’s unnecessary.

design is a marketing channel, and good marketing is a moat. so the first thing i want to do at Merge Freeze — a 3+ year old project — is upgrade from Bootstrap 4 to something a little bit… sexier.

if you’re bearish about this, consider these 2 practical reasons to play with design immediately following an acquisition.

first, a fresh look instantly communicates “we are investing in this project” to prospects and customers. second, new designs allow us to fit more content on the page, improving our chances of ranking in organic search.

Add value

every product operator has a list. this list is full of something called “feature requests.”

but eventually we get disenfranchised with building new features. we stop believing they can move the needle (because they often don’t), and we get comfortable with our product’s status quo.

when you buy a company, it’s prudent to avoid this mindset. a new feature doesn’t have to bloat your interface, increase technical debt, or require customer education. below are several ideas i drafted within 48 hours of acquiring Merge Freeze that won’t impact current customers at all.

in case you don’t speak blur, here are a couple translations. Merge Freeze integrates with GitHub. but what about BitBucket and GitLab? currently we allow 1-stroke freeze commands from Slack. what if we add support for Discord and Microsoft Teams?

i’m not saying these are good ideas, but this approach allows you to maintain an identical user experience for current customers, while also exploring new audience segments with similar use cases.

if you buy an app that works standalone, just peruse the last 300 support tickets handled by the former team. that’s your “how to add value” playbook.

Go to market

Merge Freeze is already live on the market. it’s used by 100s of organizations, including household names like [Redacted] and [Redacted]. (placeholder: awaiting permission from team leads)

what GTM means in this case is going “back” to market:

- informing current customers we’re the new owners

- asking them earnestly how we can improve the product

- rapidly building [sometimes pet] features for top customers to earn trust

- experimental marketing campaigns

since Merge Freeze has a 100% free plan for open source projects, one example of an experimental marketing campaign would be identifying huge, open source projects that became infamous for merging malicious code.

we can share tips with these projects’ contributors about the preventive power Merge Freeze, and encourage them to try it out at their job. the working theory? most engineers maintaining huge open source projects work full time at kickass companies.

deal logistics

we’ve bought, built, and sold a handful of projects since 2017. i’m excited to share today that Merge Freeze was our fastest deal in Fork Equity’s history.

Feb 1 – introduction to founder

Feb 5 – offer sent

Feb 6 – counter offer + acceptance

Feb 7-9 – contract

Feb 10 – begin due diligence

Feb 11 – finish due diligence

Feb 12 – wire sent

Feb 14 – funds received

Feb 15 – asset transfer complete

to stay in the loop on Merge Freeze email [email protected], subject line “subscribe” and i’ll BCC you on infrequent newsletters. you can also install it for free on open source projects.

if you have question about this deal, leave a comment below or tweet at me.

Did you eliminate the “unfreeze single PR option”? We were in the middle of a freeze which we’ll now have to end because we can no longer find that button in the UI.

doh! just added it back, thanks Zach.